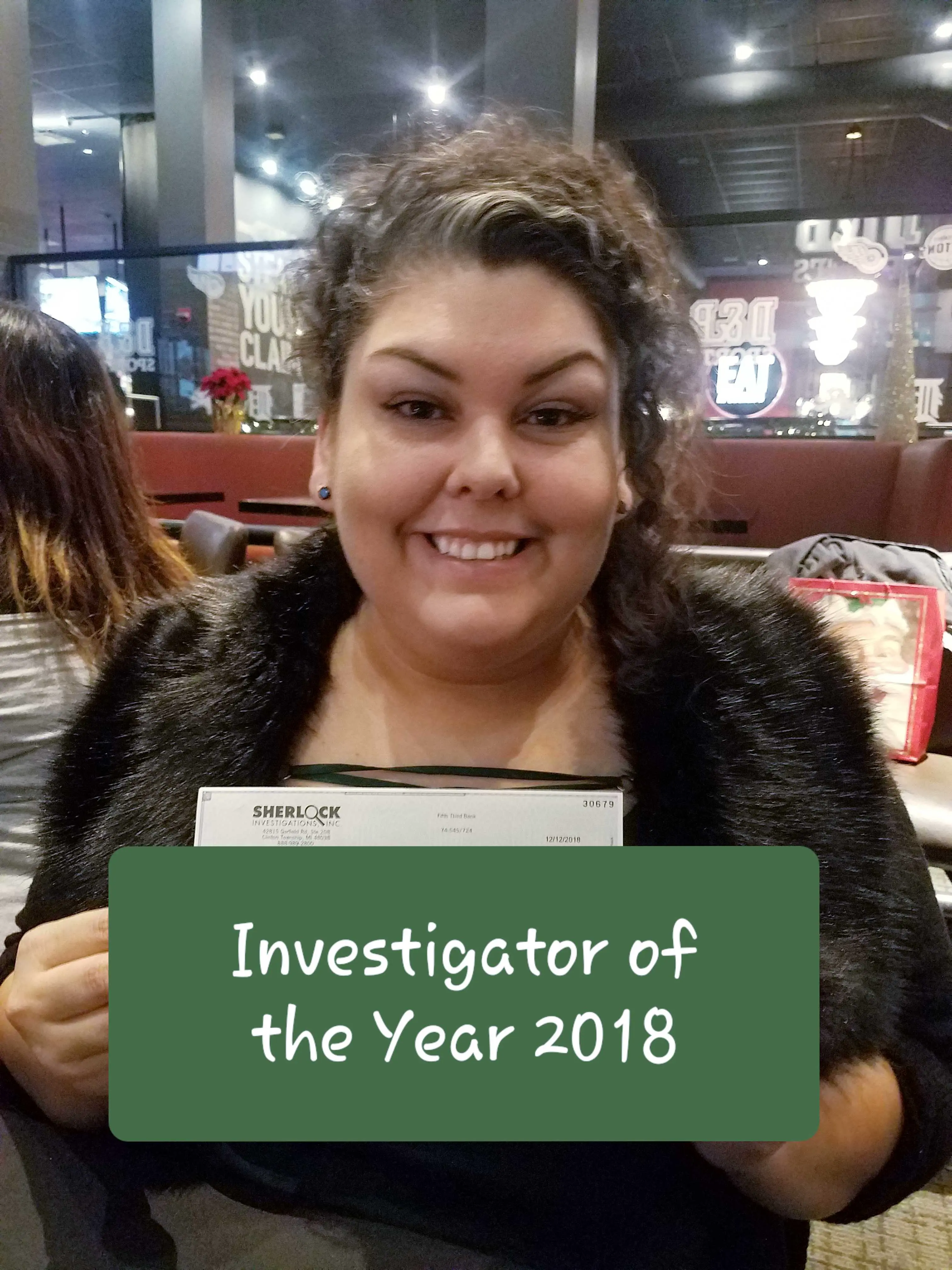

Sherlock Investigations: Tricks of the Surveillance Trade – Bodashia

Sherlock Investigation’s Tricks of the Trade Investigator Bodashia Grimm has returned with more experience to divulge! Bodashia continues to pay it forward by organizing charitable events such as our company’s participation in the Polar Plunge for the Special Olympics and by representing the company at recruiting events. Her bright personality and alluring smile make Sherlock … Sherlock Investigations: Tricks of the Surveillance Trade – Bodashia